Smartphones and Crypto: The Future of Mobile Wallets and Transactions

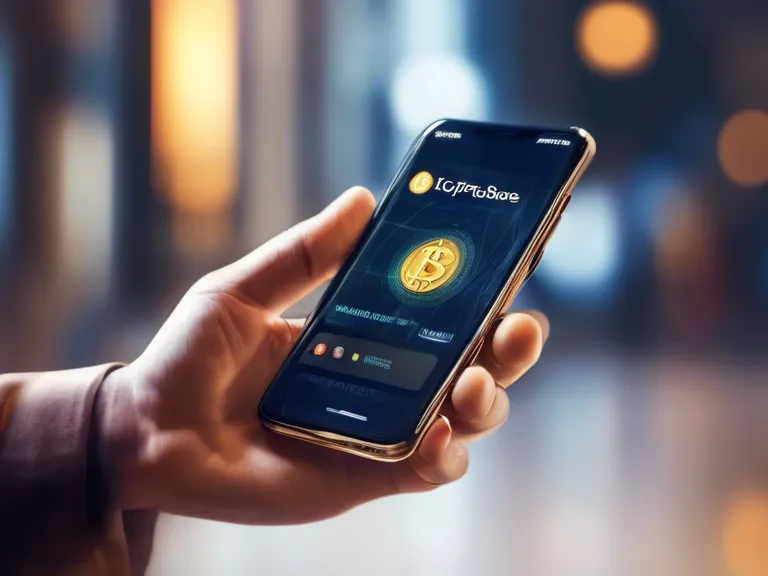

Smartphones have revolutionized the way we communicate, shop, and interact with the world around us. With the rise of cryptocurrencies like Bitcoin and Ethereum, smartphones are now playing a pivotal role in shaping the future of mobile wallets and transactions.

Gone are the days of carrying around bulky wallets filled with cash and credit cards. Today, all you need is your smartphone to make payments, track expenses, and even invest in digital currencies. Mobile wallets have become increasingly popular as more people embrace the convenience and security they offer.

Cryptocurrencies, on the other hand, are digital assets that use blockchain technology to secure transactions and verify the transfer of assets. With the growing acceptance of cryptocurrencies in the mainstream economy, mobile wallets are now integrating support for digital currencies, allowing users to store and manage their crypto assets alongside traditional currencies.

One of the key advantages of using a mobile wallet for cryptocurrencies is the ability to access your funds anytime, anywhere. Whether you're traveling abroad or simply shopping online, you can easily make transactions with just a few taps on your smartphone. This level of convenience is unparalleled compared to traditional banking systems.

Furthermore, mobile wallets offer a higher level of security for your digital assets. With features like biometric authentication, encryption, and multi-factor authentication, mobile wallets are more secure than physical wallets or online banking platforms. This gives users peace of mind knowing that their funds are safe and protected.

In conclusion, smartphones and cryptocurrencies are reshaping the future of mobile wallets and transactions. As more people adopt digital currencies and embrace the convenience of mobile payments, we can expect to see a continued evolution in how we manage our finances in the digital age.